- This article will provide information about the classic 60/40 portfolio composition model and its performance over the past twelve months, according to the 1st Annual Report of the Asset Securitization Sector.

- The information in the article is useful for asset managers seeking an analysis of the relevance of this investment approach and its prospects in a changing environment.

- FlexFunds enables the securitization of portfolios through different investment vehicles. Contact us!

The 60/40 portfolio composition model is a very popular investment strategy used by thousands of managers. Its fundamentals are simple and solid: 60% of assets are allocated to stocks and 40% to bonds. The goal is to achieve a balance between returns and risk.

A significant portion of the portfolio (60%) is devoted to equities, which have a much greater potential for high returns, while 40% in fixed income provides the necessary stability for times of recession or complex market conditions.

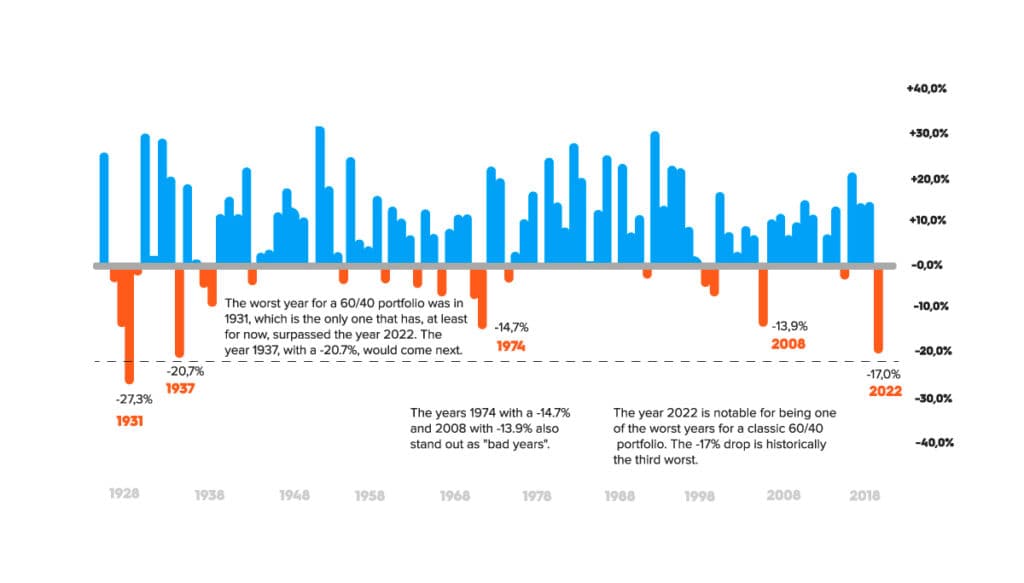

However, despite its logic, this model has proven to be a drag on investments in recent times. 2022 has been one of the worst years for the typical 60/40 portfolio.

The returns have been very negative, with a typical portfolio consisting of 60% American equities (mainly the S&P 500) and 40% fixed income (10-year American treasuries) recording a return of -15% in 2022.

Is it the End of the Dominance of the 60/40 Model?

The returns obtained in the last twelve months with the 60/40 model suggest that this investment approach is exhausted in the current environment. Its returns were even worse than during the major financial crisis of 2008, as shown in the figure.

What could have happened? Is it a structural change? The reality is that more than 68% of respondents believe that the 60/40 model did not work in the last twelve months, according to the I Report of the Asset Securitization Sector prepared by FlexFunds, which can be downloaded here.

With the opinions of nearly a hundred experts in portfolio management, among the most cited reasons, the rise in interest rates (75%) stands out, while almost 10% argue that it was due to the decline in equities.

Currently, we live in a very changing environment, with numerous external factors directly influencing economic evolution that are difficult to predict and control. In such an environment, classic recipes do not work, and traditional models are constrained by a new context. The challenges in asset management are enormous.

The increase in interest rates by central banks over the last year and a half led to a situation where the returns of fixed income became increasingly attractive after years of flat rates in the Eurozone and the United States.

This growing incentive to enter bonds coincided with a period of enormous volatility in stock markets. The war in Ukraine and a series of events made it an unsettled year despite positive growth rates and the good performance of labor markets.

Last year broke the usual relationship between bonds and stocks, whose behavior usually goes in the opposite direction and with different behaviors in different market conditions.

Thus, the 60/40 strategy did not work: both fixed income and equities lost value in a situation where solid defensive instruments were not found. Figure 1 shows that 2022 has been one of the worst years for 60/40 portfolios, following 1931 and 1937.

Despite all this, the FlexFunds Report is clear in its conclusions: regardless of the poor results in 2022 for these portfolios, the majority of investment managers (59.3%) believe that the 60/40 model will remain relevant in the future.

The 60/40 Model Still Has Room to Run

Six out of ten respondents continue to advocate for the 60/40 model, seeing 2022 as a compilation of exceptional circumstances. However, almost three out of ten state that its relevance will diminish over time.

Who is right? The majority or the minority predicting the end of a classic? Its future relevance will depend on how the markets and economic conditions evolve, but the 60/40 model is still very present in portfolio management.

The results of this model in the past year fell far short of meeting investor expectations, indicating that it is not a model with the necessary balance in a new and changing macroeconomic environment.

It is paradoxical that, despite most respondents believing that the model did not work last year, the opinion that it will continue to be a relevant strategy in the future is also in the majority.

If you have any questions or comments, feel free to contact us at info@flexfunds.com for more information or to discuss any aspect related to the report.