- This article explains how combining investment funds and ETPs enables a smart strategy focused on diversification and simplicity.

- The information is primarily targeted at asset managers and investment advisors seeking to understand the importance of diversification through investment funds.

- At FlexFunds, we provide asset securitization solutions to issue exchange-traded products (ETPs) that enhance distribution on international private banking platforms for a portfolio. For more information, feel free to contact our team of experts.

Nowadays, asset managers can implement multiple strategies to meet their clients’ goals and needs. One of the most popular strategies is combining investment funds with exchange-traded products (ETPs). Here are five key benefits of implementing said strategy:

- Diversification.

- Professional management.

- International access.

- Simplicity.

- Low costs.

Diversification

One of the most significant features of strategies combining investment funds and ETPs is the broad diversification achieved.

Using just a few financial vehicles, an asset manager can access portfolios containing dozens or even hundreds of stocks, bonds, commodities, and other financial assets. This helps maintain long-term stability and protect returns.

“One fund could include tens, hundreds, or even thousands of individual stocks or bonds in a single fund. So, if 1 stock or bond is doing poorly, there’s a chance that another is doing well. That could help reduce your risk—and your overall losses,” explains Vanguard.

Diversification can modify key parameters of a portfolio, such as volatility, maximum drawdown, and annual return.

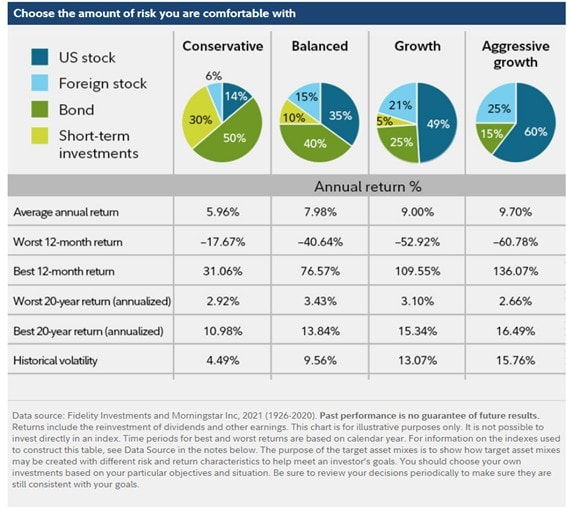

In fact, an analysis by Credit Financier Invest (CFI) concluded that a conservative portfolio comprising 50% bonds, 30% short-term investments, 14% U.S. stocks, and 6% foreign stocks can yield an average annual return of 6%, with historical volatility of 4.5% and a maximum negative return of 18%.

Conversely, an aggressive portfolio with 60% U.S. stocks, 25% foreign stocks, and 15% bonds could generate an average annual return of 9.7%, but with historical volatility of 16% and a maximum 12-month drawdown of nearly 61%.

Professional management

Portfolios blending investment funds and ETPs benefit from specialized professional management.

While an asset manager is trained to handle investments, they might lack expertise in niche areas such as emerging market commodities or private equity technology firms.

Opting for funds managed by experts helps mitigate risks and enjoy the best investment opportunities available.

International access

Many investment funds, and especially ETPs, provide access to international investments that may not be listed in local markets.

For example, some emerging market stocks lack American or European depositary receipts, making them accessible only via ETPs, such as those developed by FlexFunds.

These ETPs are created through an asset securitization process that transforms an asset or asset basket into bankable assets with their own ISIN/CUSIP code, allowing them to be purchased from any brokerage account.

Simplicity

Strategies involving investment funds and ETPs are characterized by exceptional simplicity, both for investors and asset managers overseeing general administration.

Avoiding the need to manage multiple accounts, individual assets, and operational conditions allows for more focus on what truly matters: asset allocation.

“By mixing and matching the qualities of the asset classes, an investor or financial adviser can make a portfolio less volatile and potentially achieve the same returns as or better than a riskier portfolio. Asset allocation takes advantage of the principle of diversification to reduce risk,” explains Fidelity.

Low costs

Finally, it’s important to emphasize the cost savings generated by managing a strategy with investment funds and ETPs. These savings can be passed on to the end client through reduced fees, which is critically important.

According to a report by the U.S. Securities and Exchange Commission (SEC), over 20 years, $100,000 invested at an annual return of 4% would grow to $210,000 with an annual fee of 0.25%, less than $200,000 with an annual fee of 0.50%, and approximately $180,000 with an annual fee of 1%.

Fortunately, investment funds fees have been steadily declining. According to Morningstar, the average fee paid by fund investors dropped from 0.87% in 2004 to 0.36% in 2023.

For these reasons, building a strategy with investment funds and ETPs has become one of the most sensible options for asset managers today.

For more information about ETPs developed by FlexFunds, you can easily contact our team of specialists. We’ll be happy to assist you!

Sources:

https://investor.vanguard.com/investor-resources-education/etfs/etf-vs-mutual-fund

https://cfifinancial.com/en/educational-articles/risk-management/importance-of-diversification-in-portfolios

https://www.fidelity.com/insights/investing-ideas/glossary-asset-allocation

https://www.sec.gov/investor/alerts/ib_fees_expenses.pdf

https://www.morningstar.com/funds/fund-fees-are-still-decliningbut-slower-pace