- This article explains what a REIT is, how it works, and the different types that exist, highlighting their benefits, risks, and growth outlook.

- Meant for investors interested in diversifying their portfolios with real estate instruments without directly purchasing property.

- FlexFunds offers efficient investment vehicles to structure products with exposure to REITs. Contact us for more information.

Real estate investment funds, also known as REITs, can be an alternative for generating returns from the real estate market without directly investing in a property. However, what are the pros and cons of this instrument?

Although its origins date back to the 1960s, this type of investment instrument has gained more attention recently. As a result, it has positioned itself as an important alternative in the real estate sector.

What Is a REIT?

REITs are a type of fund constituted through a publicly traded company that owns various assets in the real estate sector to obtain returns from them.

U.S. REITs must legally distribute at least 90 % of their taxable income as dividends, mainly from rental profits, providing regular income to investors.

The asset basket that makes up a REIT fund includes everything from offices, residential real estate, shopping malls, hotels, and industrial-use properties.

In addition, these companies must invest at least 75 % of their assets in real estate, and to be incorporated, they must have a minimum of 100 shareholders, according to IG.

Consequently, REIT funds have been vital for investors to be exposed to the real estate sector and generate returns derived from projects of significant potential without having to be direct partners.

Specifically, through REITs, investors acquire packages of shares of these publicly traded companies, and professional fund managers manage these assets to generate those returns.

Gain real estate exposure with REITs, professionally managed and structured by FlexFunds.

What Types of REITs Exist and How to Invest?

The real estate investment fund business is divided into three main categories:

- Equity REITs: focus on owning and managing income-generating properties.

- Mortgage REITs: specialize in financing real estate through mortgages and earn from interest.

- Hybrid REITs: combine property ownership and mortgage financing strategies.

REITs that invest in property are the most popular and are primarily focused on managing assets for rental income or sales appreciation.

Meanwhile, mortgage REITs provide financing for real estate development and profit from the interest earned on these loans. Moreover, mixed REITs combine these two approaches to offer returns to their shareholders either through properties or mortgages.

How to Invest in REITs

If you’re wondering what is a REIT and how you can invest in them, some options include specialized investment funds or ETFs. These aim to “replicate the investment results of an index made up of real estate investment trusts,” as the American investment management firm BlackRock explains.

Similarly, you can start investing by directly buying REIT shares.

REITs: Do They Generate Returns?

Although REITs have been characterized in recent decades for offering attractive returns, you must keep in mind that they correlate with the markets as they are financial assets and therefore are more susceptible to volatility compared to traditional investment in real estate.

On the other hand, REITs offer significant liquidity to investors.

For instance, in markets like the U.S., these funds must distribute at least 90 % of their annual net income through dividends to different shareholders, according to the regulations defined within the United States.

As a result, REITs have certain tax benefits since these companies are generally exempt from corporate taxes.

What is the Estimated Performance of a REIT?

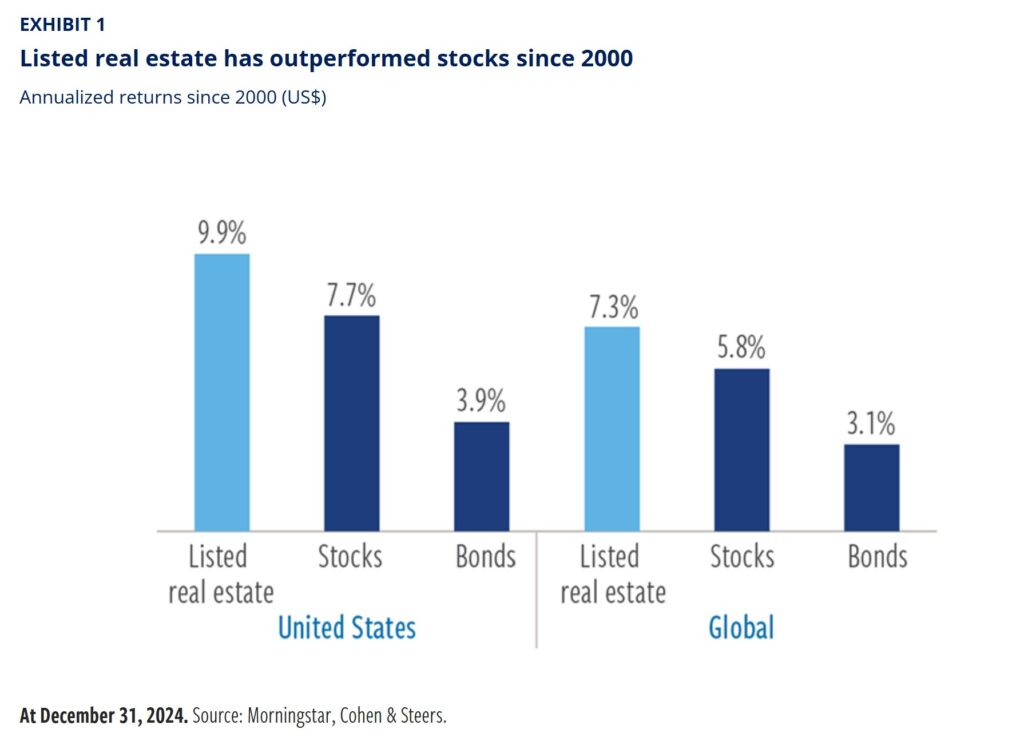

REITs are estimated to generate average absolute and relative returns of 9.9 % annually in the U.S. In comparison, globally, this can be as high as 7.3%, thanks to “REITs’ stable business models, focused on acquiring and developing high-quality assets that generate recurring lease-linked income”, according to an analysis by US investment management firm Cohen & Steers.

H2: How Much Is This Business Growing?

According to the National Association of Real Estate Investment Trusts (NAREIT), by the end of 2022, REITs in the U.S. held approximately US$4.5 trillion in real estate assets and owned over 535,000 property units.

Furthermore, REIT funds contributed to about 3.2 million full-time jobs in the U.S. in 2021. Additionally, they also helped to finance 1.7 million homes within that market.

The business size can be measured by the market capitalization of REITs listed in the U.S., which is estimated at US$1.4 trillion, based on Nareit figures. This association highlights that the business has proven resilient despite a more challenging economic outlook in recent years.

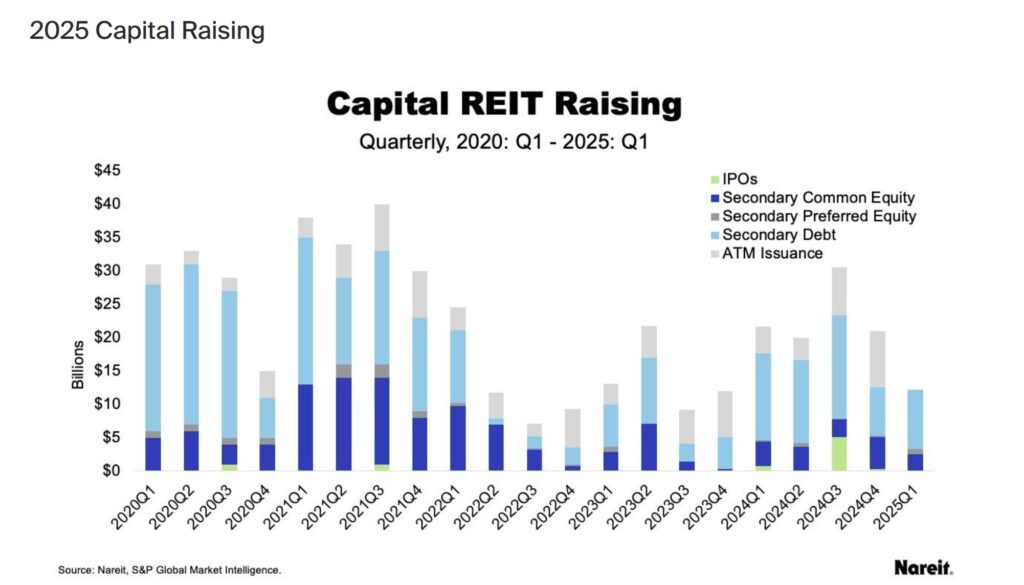

As of the first quarter of 2025, U.S. REITs raised $12.2 billion through secondary debt and equity offerings.

Despite ongoing economic challenges, experts believe that REITs have demonstrated resilience. Thanks to their disciplined balance sheets, lower debt costs, and access to various capital sources position them well for growth. Consequently, this strategic positioning allows for REITs to capitalize on opportunities as public-private real estate valuations converge and property transactions increase.

With this outlook, experts believe that REITs are an exciting option for investors looking for an instrument that offers liquidity and allows them to diversify their portfolios without worrying about buying and managing real estate.

In times of high inflation, like the current global environment, REITs can be used as a hedge because rental prices usually adjust with inflation, as many leases are indexed to the Consumer Price Index (CPI).

REITs, like all investments, carry certain risks. These include:

- Natural market fluctuations can affect returns.

- Income may not be received on a consistent or predictable schedule.

- Other factors, such as management strategy or economic conditions.

Understanding these factors is key to knowing what is a REIT and how to identify good investment opportunities.

How FlexFunds Can Help

REITs offer a flexible and accessible way to invest in real estate without needing to own or manage physical properties. With potential for regular income, diversification, and inflation protection, REITs remain an attractive option for investors.

At FlexFunds, we help asset managers and financial institutions structure investment vehicles, like REITs, to access global capital markets efficiently. Interested in learning more? Contact us today to explore how we can support your investment strategy.

Sources:

- https://www.investopedia.com/articles/pf/08/reit-tax.asp

- https://www.ig.com/es/estrategias-de-trading/-que-son-los-reits-y-como-operar–230209#son

- https://www.blackrock.com/mx/intermediarios/productos/239482/ishares-cohen-steers-reit-etf

- https://www.cohenandsteers.com/insights/strong-foundations-the-case-for-listed-real-estate/

- https://www.reit.com/news/blog/market-commentary/reits-raised-122-billion-capital-offerings-2025-q1