- This article highlights the importance of fund flows for asset managers and how their evolution is crucial for hedge fund portfolio construction.

- Starting in July 2020, investors began returning to hedge funds, marking positive capital flows for two consecutive months after a period of withdrawals.

- Hedge funds closely monitor market developments to strategize effectively. Deep analysis is necessary to take action. Contact us for more information!

By: Héctor Chamizo

The past few years have marked a turning point in the hedge fund industry, not only due to the challenging global context but also because of the adaptations and strategies fund managers have implemented to navigate turbulent waters.

From 2020 to 2024, fund flows have experienced significant changes, reflecting not only market volatility but also the evolution of investment strategies. What are hedge fund managers focusing on in the current investment landscape?

Evolution of fund flows since 2020

First, it’s essential to set the context. 2020 marked a turning point for the global economy, with the COVID-19 pandemic acting as a catalyst for unprecedented market changes. Hedge funds, known for their ability to generate alpha in challenging market environments, were no exception.

During this period, there was a significant initial outflow of investments due to increased risk aversion among investors. However, this scenario began to change as managers adjusted their strategies, focusing on specific opportunities arising from market volatility.

During 2021 and 2022, a notable recovery in fund flows towards hedge funds was evident, driven largely by interest in alternative strategies such as investments in digital assets and rising inflation, which led investors to seek effective hedges.

Traditional investment fund managers who quickly adapted and capitalized on these emerging trends not only survived but thrived, capturing a significant portion of the new capital flows.

In 2022, hedge funds faced their worst performance since 2008, with an average return of -8.22% on a fund-weighted basis. This poor performance led to a net outflow of $323 billion in 2022, representing more than 6% of the industry as a whole.

Despite net outflows and a negative average return, the AUM (Assets Under Management) of hedge funds remained stable in 2022, indicating significant dispersion in fund performance, with some large players like Citadel and Elliott significantly outperforming their peers, according to Deloitte.

As we move during 2024, there appears to be a shift in capital flow trends. Although the specific industry report for 2024 is not yet available, an indication of this trend change is seen in the positive capital flows recorded for two consecutive months, starting in July 2020, following a four-month period of withdrawals.

Capital movements in 2024

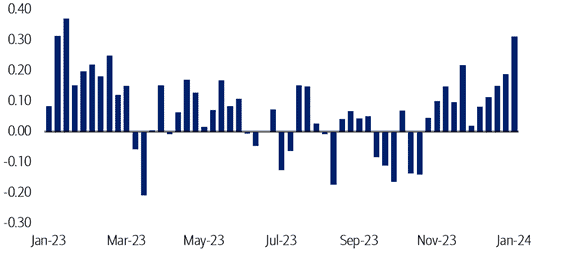

Where is the money going in the current context of 5.5% interest rates in the United States and an uncertain macroeconomic backdrop? The latest data from Bank of America shows that fund managers are increasingly positioning themselves in fixed-income assets. Specifically, the investment trend in bonds has grown stronger, taking reference from November 2023.

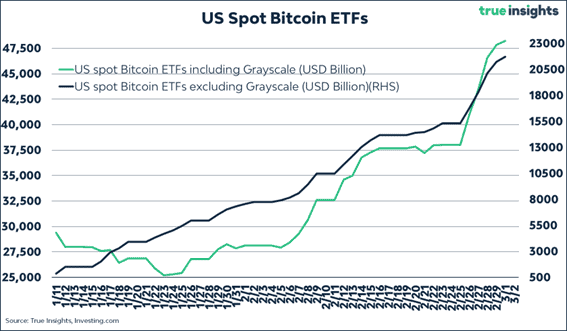

Additionally, fund managers are increasingly positioning themselves in Bitcoin. For example, in the first seven weeks since the launch of spot Bitcoin ETFs in the United States, record inflows have been achieved, accumulating more than $48 billion.

Capital flows have progressively moved towards fixed-income assets since late 2023 and have accelerated at the beginning of 2024.

In fact, the volume of Bitcoin ETFs now equals approximately 25% of physical gold ETFs.

Investment strategies in the managers’ focus

Adaptability has been key for hedge fund managers. Strategies that have gained the most relevance during this period are those oriented towards risk management and exploiting market dislocations.

Investment in technology and digital assets, for instance, has seen a considerable boom. Managers who focused on diversifying their portfolios and exploring less traditional or emerging sectors, such as renewable energy and biotechnology, have accomplished impressive results.

Additionally, relative value strategies and arbitrage operations have gained popularity, leveraging market inefficiencies to generate risk-adjusted returns. This approach has allowed managers to protect capital during market downturns and capture unique opportunities during recovery periods.

The importance of interpreting fund flows

Understanding how fund flows move and where they are heading is crucial for hedge fund managers. These movements reflect market trends and investor expectations and offer signals about risk appetite, rising or declining sectors, and potential growth areas.

Correctly interpreting these flows can provide a significant competitive advantage, allowing fund managers to proactively adjust their strategies to capture new opportunities or mitigate emerging risks.

Another tool that has gained importance in enhancing hedge funds is securitization. This technique, which involves converting assets into tradable securities, provides hedge fund managers with a way to diversify and strengthen their portfolios by creating new financial instruments.

Securitization can positively influence fund flows by providing liquidity and allowing investors access to markets or assets that would otherwise be inaccessible. Additionally, by converting low-performing or higher-risk assets into more attractive securities, hedge funds can attract a larger number of investors, thus increasing capital flows into these funds.

Challenges and future opportunities

Looking ahead, hedge fund managers face a rapidly evolving investment environment. Market volatility, geopolitical tensions, economic transitions towards sustainability, and technological innovation are just some of the factors that will influence fund flows in the coming years.

Managers who remain agile, continue investing in technology, and deepen their understanding of ESG (Environmental, Social, and Governance) factors will be well-positioned to navigate these changes and capitalize on emerging opportunities.

In summary, fund flows between 2020 and 2024 have reflected a period of transition and transformation for hedge funds and their managers. Those who have successfully interpreted these movements and adapted to them have not only survived but thrived, setting the path forward for the sector.

As we look to the future, it is clear that the ability to adapt to a constantly changing environment, supported by technology and a commitment to sustainability, will remain essential for success in the investment world.

If you have any questions or want to explore how securitization can help enhance your hedge fund distribution and facilitate access to international investors, please contact one of the securitization experts at FlexFunds for a consultation.

Héctor Chamizo

Economic journalist

Renowned journalist with thirteen years of experience in online media and print. Specialized in economics and markets, he is a contributor to prestigious publications such as Forbes, Rankia, and Funds Society.