- Financial advisors combine expertise in investment, tax planning, and asset management, helping optimize returns and minimize risks in today’s complex economic environment.

- Through products like ETPs, financial advisors can expand investment strategies. FlexFunds’ products transform assets into bankable assets, providing access to both liquid and illiquid assets.

- The integration of advanced technologies such as artificial intelligence enables product customization and democratizes access to financial instruments.

- Asset management encompasses everything from individual investments to corporate wealth, integrating physical, financial, and intangible aspects through a strategic approach.

The role of a financial advisor is multifaceted, encompassing a wide range of responsibilities—from stock markets to managing organizational resources. One of their most recognized roles involves managing assets to implement investment plans and achieve higher returns through financial vehicles. FlexFunds explains some key aspects.

Navigating the challenging waves of the global economy, selecting the most suitable financial instruments for the current environment, and enhancing portfolio composition are some of the primary responsibilities of financial advisors, who play a fundamental role in asset management and act as guides to optimize expected returns.

Asset management is a crucial task in the investment world, allowing clients of various sizes, profiles, and risk levels to identify the set of assets best suited to their needs, as well as the financial instruments that will most effectively help them achieve their goals.

Navigating global economic challenges is crucial for optimizing returns and mitigating risks. Financial advisors play a key role in this mission.

Asset managers and financial advisors do more than oversee large fortunes and guide institutional investors through numerous risks—such as inflation, high interest rates, and a noisy geopolitical environment. They also open opportunities and provide asset exposure to a broader range of participants.

Financial advisors provide strategic guidance in investments and tax management. Additionally, they assist with budgeting aligned with clients’ income and expenses, retirement planning, and wealth succession, according to FlexFunds.

The global race in financial advisory

Financial advisors are engaged in a global race to provide access to differentiated financial instruments that allow their clients to build diversified portfolios, mitigating risks associated with the markets, such as volatility and external macroeconomic shocks that constrain returns.

Amid the boom in technological solutions and an increasing need for hyper-personalized products, investors are seeking financial advice beyond traditional sources.

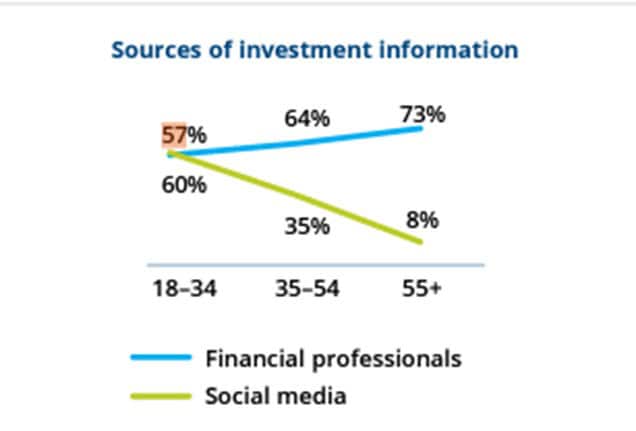

According to a Financial Industry Regulatory Authority (FINRA) study cited by the World Economic Forum (WEF)1, 60% of American investors under 35 use social media for investment information, compared to 57% who rely on financial professionals. .

Investors are not only exploring new advisory channels but are also interested in diversifying their positions and accessing various asset classes to shield themselves from current market turbulence.

In this context, FlexFunds provides solutions for asset managers and financial advisors through its asset securitization program, which creates exchange-traded products (ETPs). These products are designed to enhance investment strategies and optimize advisory operations by offering key benefits such as efficiency, accessibility, and diversification.

FlexFunds products help structure personalized investment vehicles, adapting to each client’s needs.

FlexFunds enables financial advisors to create customized investment vehicles, such as ETPs, centralizing the management of multiple accounts within a fund-like structure. This reduces the time spent on administrative tasks, freeing up resources for specific investment strategies tailored to different client profiles. This efficient approach helps increase assets under management (AUM) and maximize revenues.

These ETPs reduce administrative costs by up to 40% and significantly shorten launch times, delivering faster and more competitive market results. Additionally, FlexFunds’ products diversify financial advisors’ strategies, providing access to both liquid (stocks, bonds) and illiquid assets (real estate).

Types of financial advisors and what sets the best apart

Financial advisors generally fall into two main categories: independent advisors, who do not earn commissions and typically work on a contract basis, and dependent or ‘commercial managers,’ who sell financial products from specific institutions and earn commissions, according to BBVA3.

Key traits of a good financial advisor include the personalization of the service and products offered, with the flexibility and judgment to recommend solutions that best fit the client’s profile.

Other important elements include client communication, providing regular (typically written) and realistic updates on the performance of various instruments, and making necessary adjustments based on each investor’s circumstances and any changes that may arise during the process.

“A good financial advisor must communicate clearly and adapt to the client’s needs.”

Adopting advanced technologies like AI and data analytics is also crucial for delivering better services, enhancing product personalization, and democratizing access to various financial instruments.

In practical terms, according to BBVA3, “a good financial advisor should avoid jargon, speak clearly and directly, and guide the client through decisions by explaining the risks and benefits of each transaction.”

Corporate asset management and financial advisory

Financial advisory extends beyond market-traded financial assets to encompass the entire wealth of organizations.

In the corporate sphere, asset management and financial advisory involve a broad range of assets requiring specialized knowledge, which is increasingly supported by technological solutions.

These professionals advise on various asset classes, including physical, financial, intangible, technological, and human assets, according to an investment management report by Grupo Sura4.

It points out that effective asset management in the corporate sector requires considering factors such as a detailed inventory and classification of assets, determining their value, and conducting periodic revaluations, which account for price fluctuations due to factors like depreciation or increases in market value.

Additionally, other important processes include assessing the company’s needs to plan for the acquisition of new assets, which in turn relies on budget and financing planning. This is closely tied to decommissioning processes, involving the removal or sale of assets that are no longer useful after an evaluation of their value has been conducted.

“Effective management ensures assets are well-maintained, properly recorded, and efficiently utilized. It also ensures regulatory compliance and maximizes resource value, contributing to long-term organizational success,” explains Grupo Sura.

In summary, financial advisory is essential for navigating a complex economic environment, enabling individuals and businesses to maximize returns and protect their wealth. Financial advisors combine expertise, technology, and personalization to offer comprehensive solutions that address today’s challenges and future opportunities. Having a robust advisor who mitigates risks through diversification is crucial for navigating an equally challenging 2025, marked by geopolitical shifts and macroeconomic shocks amid a global slowdown.

Sources:

- 1https://es.weforum.org/stories/2024/07/son-los-finfluencers-el-futuro-del-asesoramiento-financiero/

- 2https://www.finrafoundation.org/sites/finrafoundation/files/NFCS-Investor-Report-Changing-Landscape.pdf

- 3https://www.bbva.com/es/salud-financiera/cualidades-buen-asesoramiento-financiero/

- 4https://www.segurossura.com.co/empresasura/Documentacion%20Formacion/cartilla-de-gestion-basica-de-activos.pdf