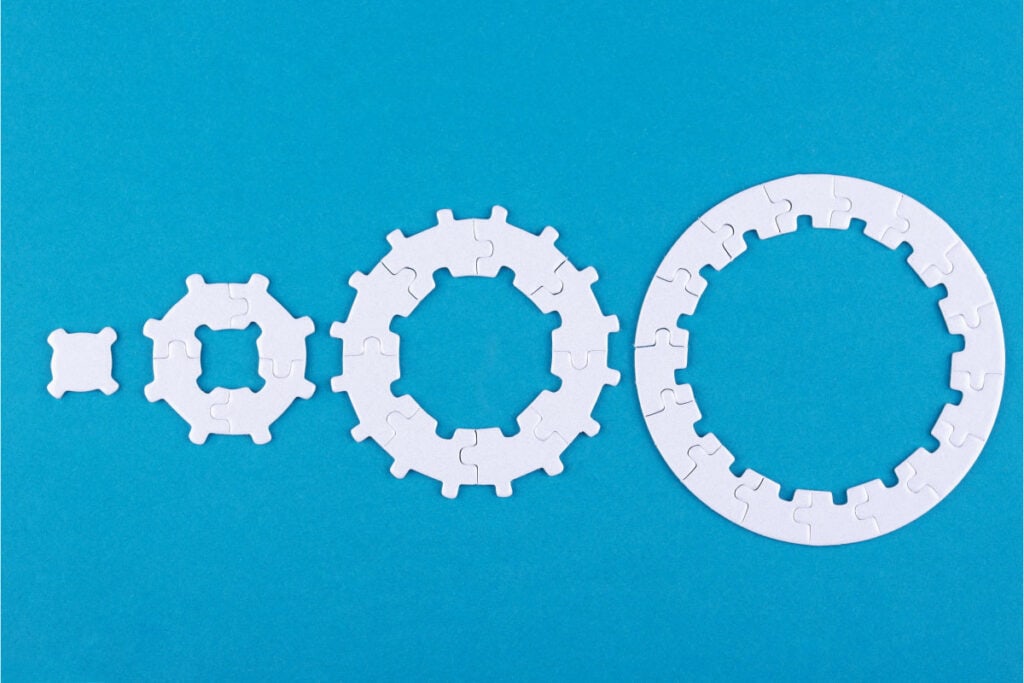

- Turning assets into listed financial instruments is a complex task involving different parties. Each responsible party has a crucial role in securitizing any underlying asset. FlexFunds facilitates this process by coordinating the issuance and aligning the different stages among the respective stakeholders.

- Besides the inherent benefits of asset securitization, the dynamism in the available asset classes helps fund managers, portfolio managers, and real estate developers grow or consolidate their investors.

- FlexFunds offers agile and efficient solutions for bringing investment strategies to the market. Contact us to determine how we can help you and what solutions better fit your goals.

As in any other capital markets issuance process, asset repackaging encompasses different actors, each performing an essential part in offering a financial product. These processes apply to both fixed-income and variable-income securities. One of the many benefits of asset securitization comes from the fact that depending on the product or strategy to be converted into an Exchange Traded Product (ETP), it can incorporate bond and stock-like characteristics, acting as a tailwind for the originator (such as investment managers or real estate developers) and the final investor (the clients of the originator) too. A telling example of these mixed characteristics is that the instrument through which the securitized product is launched to the market can be transferred and traded in a secondary market via Over The Counter (OTC) transactions, as is the case for bonds. This is accomplished thanks to the security having a tradable ISIN that clears and settles on Euroclear and Clearstream. Furthermore, the instrument can distribute frequent payments; whether these are predefined or subject to the discretion of the portfolio manager, giving an edge to the vehicle so if a payment is not executed at any given time, the security will not enter on default, resembling a dividend, a similar feature in the case of stocks.

FlexFunds plays a critical role in the development of asset securitization programs. It is responsible for coordinating and orchestrating the proper functioning of all the parties involved in the program, and performing the calculation agent role. In the following sections, we will examine the various parties involved in the securitization process and the tasks each undertakes.

- Calculation Agent: Responsible for determining the value of the repackaged instruments. The price is reflected through a Net Asset Value (NAV) and is derived from the valuation of the underlying assets, such as stocks, bonds, investment funds, real estate projects, and any other asset class, whether liquid or illiquid. The NAV of the notes issued under FlexFunds’ program is published and distributed on the main global financial information platforms, such as Bloomberg, Refinitiv, and SIX Financial.

- Issuer: Its purpose is to structure transactions through which asset securitization is completed. In the asset-backed securities industry, issuers are generally incorporated as SPVs (Special Purpose Vehicles), which benefit the investment vehicle in various ways, such as bankruptcy remoteness and tax advantages, to name a few.

- Issue and Principal Paying Agent: It oversees taking to market the securitized product used in the structure. Additionally, acting as a paying agent, it consolidates and executes principal and interest distributions to noteholders. These payments are made through clearing systems, eliminating counterparty or default risk.

- Trustee: It protects the collateral of the assets on behalf of investors, so in an event of a breach of the agreed terms and conditions, it can intervene and recover the investment on behalf of the noteholders. Therefore, when issuing a tranche (increasing the outstanding amount of the notes), the issuer grants the underlying assets as collateral to the trust, which can only be enforced under certain conditions. The trust provides legitimacy and transparency to the issuance process and renders reliability to investors.

- Stock Exchange: A marketplace where buyers and sellers meet to trade securities; such securities must be listed on the exchange to be quoted. Once listed, the asset is officially a negotiable security. Under the FlexFunds program, the notes are listed on the Vienna Stock Exchange, specifically on the Vienna MTF.

- Custodians: These usually are banks or financial institutions that safeguard shares, bonds, derivatives, and cash, among others. Some custodians may offer brokerage services through proprietary platforms or third parties, allowing investors to buy and sell financial instruments. When bringing investment strategies involving liquid assets to market, FlexFunds’ FlexPortfolio offers the possibility of using top-tier regulated custodians such as Bank of New York and Interactive Brokers, granting the portfolio manager a wide range of products to achieve their financial plans.

- Auditor: Having auditors strengthens internal controls and processes, enhancing the credibility of all the involved parties, which benefits asset securitization. Audits increase investor confidence when deciding where to allocate funds among the multiple products and structures available in the market.

One of the many advantages of FlexFunds’ global notes program, used to turn assets into securitized products, is that the time to market and complete an issuance takes between 8 and 12 weeks, considerably faster than other alternatives investment vehicles.

To learn more about the solutions offered by FlexFunds and how to level up your investment strategy distribution and expand your client base, contact our team of experts.

Sources:

https://www.investopedia.com/ask/answers/09/bond-over-the-counter.asp

https://corporatefinanceinstitute.com/resources/equities/stock-exchange

https://www.pwc.com/gx/en/banking-capital-markets/publications/assets/pdf/next-chapter-creating-understanding-of-spvs.pdf