- The evolution of capital markets and financial engineering has enabled an increased offer of investment products. The positive impact that these products have generated has not been isolated for investors; they have also been beneficial for portfolio managers.

- The goals of the asset managers’ clients will vary, as will the asset classes that they seek and the instruments by which their investments are routed.

- FlexFunds coordinates an asset securitization program, for both listed and alternative assets that helps asset managers to distribute investment strategies to the market in a fast and efficient manner. To get to know more about it, contact our team to determine which solution suits your needs.

The financial industry and the capital markets have evolved substantially. In recent years, the significant technological advancements have not been exclusive to the biotech or information technology sectors but have been made available to finance as well. The launch of financial instruments such as money market funds, treasury inflation protected securities (TIPS), REITS, zero-coupon bonds, or asset backed securities (ABS), to mention a few, have made the market activity soar and created new business opportunities in the asset management industry. The integration of these alternative assets into the industry has given market participants the chance to go after strategies that align with their objectives while they diversify their holdings. This innovation in financial products creates a win-win scenario for both investors and portfolio managers. Investors gain access to a broader range of opportunities. At the same time, asset administrators benefit from an expanded client base, leading to significant growth in the Assets Under Management (AUM) and, ultimately, higher income.

One of the products that has been gaining traction for the investment managers and their client’s portfolios are Exchange Traded Products (ETP). The ETPs are a category of investment vehicles that cover Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN). Exchange Traded Products are designed to provide performance and exposure based on an underlying asset. Depending on the strategy’s purpose, the product’s structure will be modified. For instance, a strategy that seeks to offer an illiquid asset to different groups of investors might securitize such alternative assets through an ETN. Basically, any cash flow produced by the underlying can be passed through to the note holder as an interest since the notes operate as a fixed income instrument. FlexFunds’ Flex Private Program coordinates the issuance of an investment vehicle that allows the repackaging of multiple alternative strategies, granting liquidity and easing the distribution of this type of project on international private banking platforms.

Given their nature, alternative assets are targeted at sophisticated or institutional investors. These products have less liquidity and may require more extended than usual holding periods.

Suppose the alternative asset manager focuses on structuring and distributing liquid or listed strategies. In that case, FlexFunds’ FlexPortfolio allows them to package this type of instruments in an agile and cost-efficient manner. The FlexPortfolio empowers portfolio managers to launch investment strategies to the market efficiently through a single, listed security. This approach streamlines the process, potentially reducing time to market and structuring costs by up to half compared to traditional investment funds.

Let’s review what are some of the benefits of asset securitization for alternative asset managers:

- Pool assets from different sources in a single security, enabling the administrators to participate in high-capital projects by facilitating the fractionalization of investments. This allows them to distribute ownership shares among a wider range of clients.

- Endowment of liquidity: The outcome of the securitization process for any asset is a marketable product with an International Securities Identification Number (ISIN) that can be purchased and sold through Euroclear and Clearstream, allowing custody in a brokerage account.

- Ensure Transparency: The portfolio administrator reports all the holdings that compose the product. Additionally, any proposed changes to the initial investment strategy must be processed through a Corporate Action.

- Safeguard Underlying Assets: The issuance structure utilizes a Special Purpose Vehicle (SPV), effectively isolating the underlying assets from any potential credit risk associated with the asset management firm. This structure directly benefits investors by mitigating potential credit exposure.

- Avoid dilution among existing clients: The structure and operability of the ETP protect current participants from dilution, considering that subsequent subscriptions are made at the latest available Net Asset Value (NAV), which is publicly distributed on the leading financial data platforms.

As asset managers increasingly incorporate alternative assets into their investment strategies, securitization programs emerge as valuable tools for portfolio diversification. The growing popularity of non-traditional investment vehicles stems largely from current market conditions, and their selection often aligns with specific investment objectives. Let’s delve into the role of alternative assets in asset securitization programs:

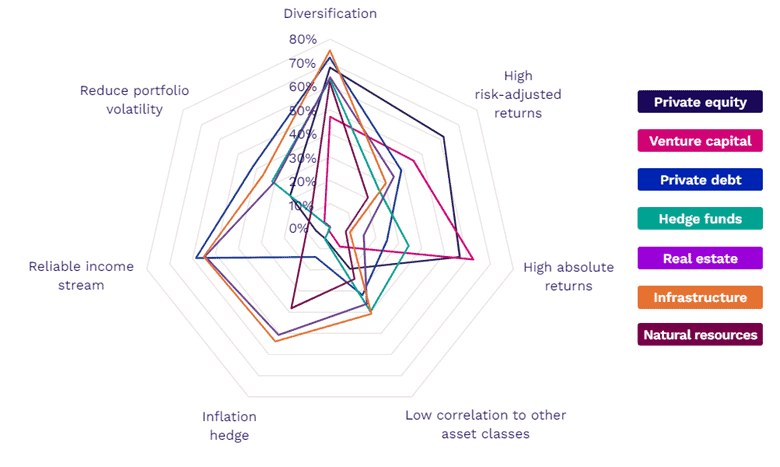

As shown in the above graph, depending on the vehicle type, the reasons may vary. If the goal is to seek diversification, private debt and infrastructure, among others, will be the investment choices. Conversely, if the purpose is to achieve high risk-adjusted returns, private equity is the way. The solutions offered by FlexFunds grant any asset and investment strategy the possibility to be securitized independently of liquidity, investment horizon, or jurisdiction.

If you wish to know more about how asset securitization can enhance your investment strategy distribution, whether it is based on alternative asset management or in a listed instruments approach, reaching a wide access to international investors, please contact our team of experts.

Sources:

1https://flexfunds.com/flexfunds/webinar-more-efficient-investment-vehicles-than-traditional-investment-funds/

2https://www.preqin.com/academy/lesson-1-alternative-assets/why-invest-in-alternatives/