- Asset-backed securities (ABS) have undergone a remarkable evolution, transforming from simple financial products backed by debt into sophisticated and diversified instruments. This transformation has enabled the securitization of a wide variety of asset classes, cementing their role as a key tool in asset management.

- ABS offer attractive opportunities by diversifying portfolios and optimizing returns. However, they also carry significant risks that require a deep understanding and rigorous evaluation before issuing or investing in them. Recognizing these challenges is essential to making informed and strategic financial decisions.

- FlexFunds coordinates a program for repackaging assets, whether listed or alternative, helping portfolio managers consolidate investment strategies through listed securities. To learn more about it, contact our team to determine which of our solutions best suits your needs.

Asset-backed securities (ABS) are financial instruments that transform a pool of underlying assets, whether liquid or illiquid, into tradable securities. These instruments are issued through a securitization process, creating securities that are then distributed to a wide range of investors. This sophisticated structure allows market participants to access diverse investment opportunities through products listed on stock exchanges.

Initially, the Asset-backed securities market focused on limited segments of the financial industry, specifically debt, serving a small group of investors. As the market evolved, it now encompasses a diversified universe of asset classes, attracting investors and managers seeking to launch various strategies. One of the many advantages of asset securitization is its flexibility in the types of assets that can be packaged -regardless of their characteristics- transforming any strategy into a liquid security suitable for distribution in brokerage accounts. Through its asset securitization program, FlexFunds offers a range of options for portfolio managers, real estate developers, or asset managers, enabling them to securitize various strategies and financial instruments.

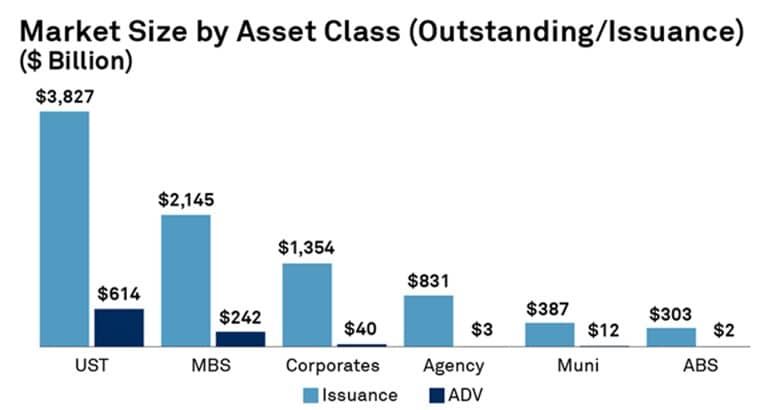

As an emerging category, ABS still represents a small portion of fixed-income strategies. In 2023, these assets accounted for just 3% of the total debt instrument issuances in the United States:

Thanks to their versatility and the solutions they provide, the ABS market is expected to grow globally at a compound annual growth rate (CAGR) of 8% from 2024 to 2032, reflecting the increasing demand to securitize diverse products. The rise of non-traditional assets is driving the securitization industry by diversifying the products available for packaging, such as fintech loans, royalties, and renewable energy projects, to name a few. According to the II Annual Report of the Asset Securitization Sector, which compiles insights from 100 different financial sector firms across 18+ countries, investment managers’ primary assets sought for securitization include real estate projects, loans and financial contracts, and stocks.

This expansion attracts a broader range of investors seeking diverse and high-yield opportunities. It also fosters financial innovation and enhances market resilience by reducing dependence on traditional asset classes. The evolution and acceptance of new types of financial vehicles will drive growth and overall market liquidity.

As with any financial initiative, the process of backing a security with one or more assets involves inherent limitations. It is crucial to identify and understand the risks associated with this practice. These risks can manifest in various ways, depending on factors such as the type of asset, market conditions, and the structuring mechanisms employed. The main risks include:

1.Regulatory Risk

Changes and adjustments in regulations can impact asset-backed securities’ structure, costs, and profile. This can increase volatility and affect the issuance of such products.

2.Operational Risk

This includes errors in pricing calculations, payment service failures for both principal and interest, and technological limitations, all of which can impact the performance of ABS and the portfolios of investors holding these vehicles.

3.Credit Risk

Interest rate changes affect asset-backed securities’ behavior, predominantly if the underlying assets consist of debt instruments. An interest rate hike increases borrowing costs, potentially leading to defaults.

These risks present challenges for the market and industry, but they can be mitigated through rigorous processes and counting with experienced teams equipped with the right tools. Under FlexFunds’ global note program, notes are issued by a Special Purpose Vehicle (SPV), which is bankruptcy remote. Thus, the underlying asset is isolated from credit risks that may affect the originator and, consequently, the investor. Furthermore, the FlexFunds program involves different parties and top-tier service providers such as Bank of New York, Bloomberg, Refinitiv, and Interactive Brokers, among others. These entities help mitigate technological, operational, and regulatory risks.

To learn more about the solutions offered by FlexFunds, including how to enhance the distribution of your investment strategy, expand your client base, and launch various strategies to the market, you can contact us, and our experts will assist you.

Sources:

https:/www.sifma.org/resources/research/insights/understanding-fixed-income-markets-in-2023

https://www.gminsights.com/industry-analysis/asset-backed-securities-market