- Securitization bonds transform illiquid assets into tradable securities, enabling companies to access capital and diversify their funding sources.

- Assets are transferred to a fund that issues bonds in different tranches, tailored to investors’ risk tolerance and appetite.

- FlexFunds converts assets into ETPs, streamlining distribution and reducing launch times in half.

Amid growing global corporate financing needs and uncertainty surrounding future monetary policy in economies like the U.S., securitization bonds emerge as a key instrument providing companies with alternative access to capital and financial markets.

In simple terms, securitization is a financial mechanism that converts typically illiquid assets—such as mortgages, loans of various types, and accounts receivable—into tradable securities to raise funds.

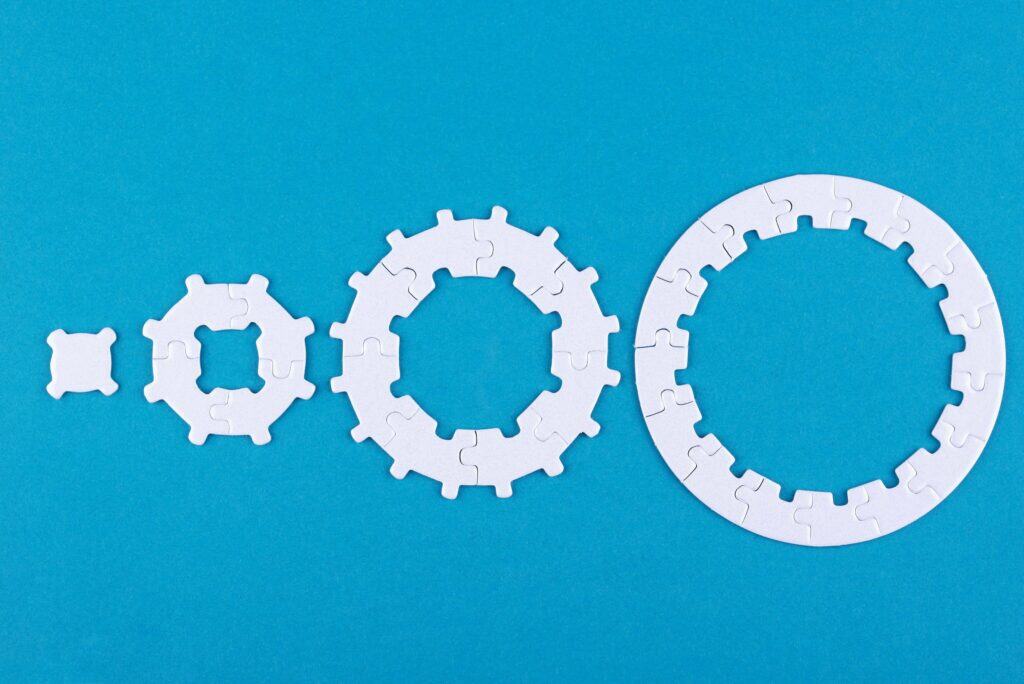

The process begins with transferring illiquid assets to a securitization fund, which operates as a separate financial entity. This fund finances the asset purchase by issuing bonds in different tranches, each carrying varying levels of risk to align with investor preferences.

The tranches of securitization bonds grant different levels of priority in payments. The least risky tranche is the first to receive income generated by the underlying assets. Typically, the structure consists of junior, mezzanine, and senior tranches, with returns increasing in line with risk.

A study by IDB Invest1 states that “securitization structures are highly adaptable to features of the underlying assets and the specific needs of investors with different risk-reward appetites.”

-Securitization not only expands financing options for businesses but also allows investors to access instruments offering attractive returns and risk diversification.

Investors acquire these securitization bonds, providing liquidity to the fund to reimburse the original asset owner. Meanwhile, debtor payments serve to repay capital and interest to investors, according to financial services firm Beka Finance.2

FlexFunds‘ securitization program, for instance, enables asset managers and financial advisors to transform a variety of asset classes—both liquid and alternative—into exchange-traded products (ETP). This mechanism not only broadens the range of investment products but also enhances their distribution through international private banking, reducing market launch times in half compared to other alternatives.

As securitization gains increasing relevance as a financing and investment optimization tool, solutions like those from FlexFunds provide a strategic avenue for enhancing liquidity, improving distribution, and facilitating the internationalization of assets in financial markets.

Types of securitization bonds and their characteristics

Securitization bonds are as diverse as the types of assets that can be converted and repackaged through this instrument. Some of the most common include:

- Mortgage-backed securities (MBS): These are bonds traded in capital markets that are backed by a portfolio of mortgage loans, either residential (Residential Mortgage-Backed Securities) or commercial (Commercial Mortgage-Backed Securities).

- Asset-backed securities (ABS): These bonds are typically backed by debt, income-generating assets, and other claims unrelated to mortgages. This category includes corporate loans, auto loans, student loans, credit card receivables, and various types of invoices.

Investment firm BlackRock notes that securitized assets have a low correlation with other fixed-income sectors3 due to their floating interest rates, which reduce sensitivity to interest rate changes. Additionally, they provide stable income through gradual amortization, ensuring consistent cash flow and liquidity. They also offer higher yields compared to other similarly rated assets.

On the flip side, securitized assets are considered complex financial instruments, typically appealing to specialized investors. They also carry several risks, including market fluctuations, potential deterioration in the quality of underlying assets, and defaults, as summarized by Beka Finance.

The role of securitization bonds in corporate financing

With high interest rates still in place, companies of all sizes face rising financial costs. Small and medium-sized enterprises (SMEs), in particular, encounter additional hurdles in securing credit.

Data from the International Finance Corporation (IFC) 4 indicates that 40% of formal micro, small, and medium-sized enterprises (MSMEs) in developing countries face an unmet financing need of $5.2 trillion annually.

According to the World Bank, East Asia and the Pacific account for 46% of the global financing gap, followed by Latin America and the Caribbean (23%) and Europe and Central Asia (15%).

-In a high-interest-rate environment, securitization bonds provide businesses with an efficient alternative to access capital without relying solely on bank credit.

At present, global financing concerns revolve around the direction of U.S. monetary policy. On January 29, the Federal Reserve (Fed) halted its cycle of low interest rates, keeping them at 4.25% to 4.5%.

Interest rates may remain elevated for an extended period due to a stronger U.S. dollar and anticipated inflationary pressures stemming from policies implemented by the new administration.

Higher interest rates translate to prolonged higher borrowing costs, impacting various industries and prompting central banks in emerging Latin American economies to approach their monetary policies cautiously.

In this landscape, securitization bonds serve as a strategic alternative for issuers, helping them diversify their investor base and funding sources while gaining access to capital markets.

-By converting illiquid assets into tradable securities, securitization enhances market liquidity and facilitates the internationalization of investments.

For investors and asset managers, these instruments contribute to risk diversification and portfolio composition, granting exposure to a variety of asset types across different regions.

In emerging markets in regions such as Latin America, securitization could become an alternative to improve credit availability from financial institutions, as well as a means to develop the capital market and expand financing options for SMEs in contexts such as rising credit costs, according to IDB Invest.

In conclusion, securitization bonds are emerging as a key financial tool in a challenging global environment, enabling companies to secure capital, diversify funding sources, and optimize their financial structure. FlexFunds plays a crucial role in this process by facilitating asset securitization through the issuance of exchange-traded products (ETP). This allows asset managers to transform various assets into tradable instruments, enhance distribution, and reduce time-to-market.

Fuentes:

1https://idbinvest.org/en/blog/author/jose-ramon-tora

2https://www.bekafinance.com/learning/alternativas-financiacion-titulizacion

3https://www.blackrock.com/institutions/en-us/insights/the-case-for-securitized-assets

4https://www.worldbank.org/en/topic/smefinance