- This article highlights the key reasons why asset management is essential for preserving and increasing capital, as well as its positive impact on portfolio diversification. Effective asset management allows for the strategic allocation of resources, mitigating risks, and maximizing returns.

- The information is aimed at portfolio managers and investment advisors who want to discover the benefits of professional asset management.

- At FlexFunds, we provide an asset securitization program to issue exchange-traded products (ETPs), which can improve the liquidity of certain assets. For more information, feel free to contact our group of experts.

Asset management is becoming increasingly relevant within the global financial industry. In fact, its importance is such that, according to a PwC report, the total assets under management (AuM) globally are growing at a rate of 6.2% annually and are expected to reach USD 145.4 trillion by 2025, compared to USD 84.9 trillion in 2016.

At the same time, the fastest growth will be seen in the emerging markets of Latin America and Asia-Pacific, and alternative assets, such as real assets, private equity, and private debt, will more than double to USD 21.1 trillion. These will represent 15% of the global assets under management.

Meanwhile, although passive management will continue to grow, active management will reach USD 87.6 trillion by 2025, representing 60% of global AuM. The difference is due to active management’s ability to preserve and grow invested capital in unfavorable scenarios.

“It is important to remember that in a rising market, passive returns are very attractive at a low cost, but inevitable market corrections will bring a continued appreciation of the value of active investments,” said Tony Oputa, Financial Services Industry Leader at PwC.

Now, how exactly does asset management help preserve and grow capital?

The importance of strategic diversification

First, asset management is essential for enhancing portfolio diversification, which balances the risk-return relationship for long-term investors.

According to a study by RBC Global Asset Management, a diversified portfolio of cash, bonds, and stocks from different countries and markets offered a historical return of 5.8% annually, with a maximum return of 12.2% and a minimum of -0.3%.

In comparison, a bond-only portfolio yielded 5%, but its maximum annual return was 8.5%, and its minimum was 0.1%. Meanwhile, focusing solely on U.S. stocks provided an average return of 7.3%, with a maximum of 21.9% and a minimum of -7.7%.

Additionally, an international stock portfolio generated an average historical return of 4.4%, with a minimum of -7.5% and a maximum of 16.8%, while emerging market stocks amplified the returns: 7.2% average annual return, a maximum of 27%, and a minimum of -7.6%.

“Remember that at any given time, a specific asset class, region, sector, or style may lead the market while others lag behind. But in a diversified portfolio, a drop in one investment can often be offset by growth in other assets,” the company explained.

Professional analysis and high-quality information

In addition to diversification, asset management companies manage their clients’ assets based on professional analysis and high-quality information.

Retail investors typically manage their portfolios using free information gathered from the internet and make decisions based on their own level of knowledge, which is not always the most appropriate.

However, in professional asset management, strategies are backed by sophisticated studies conducted by teams of experts who typically use paid data platforms like Bloomberg or Refinitiv, allowing access to a vast database in record time.

Moreover, asset management companies are increasingly using artificial intelligence (AI) solutions to optimize their analyses and better manage portfolios.

According to Global Market Insights, the AI market in asset management will reach USD 20.54 billion by 2032, implying a compound annual growth rate of 24.2% from the 2023 figures.

Part of this expansion is due to the use of new technology to analyze massive amounts of data. “In order to generate higher returns, machine learning models can help portfolio managers predict price movements and volatility by detecting the right signals in large data flows (big data),” noted Deloitte.

The firm’s specialists also explained that AI is not only applied to quantitative information but also to qualitative data, as some machine learning models even allow the creation of sentiment indicators based on social media comments. This way, the asset manager gets an indication of possible future market movements.

Sophisticated financial instruments

Furthermore, professional asset management can and often does take into account more sophisticated financial instruments, which are less accessible to retail investors, such as alternative assets, bringing significant benefits.

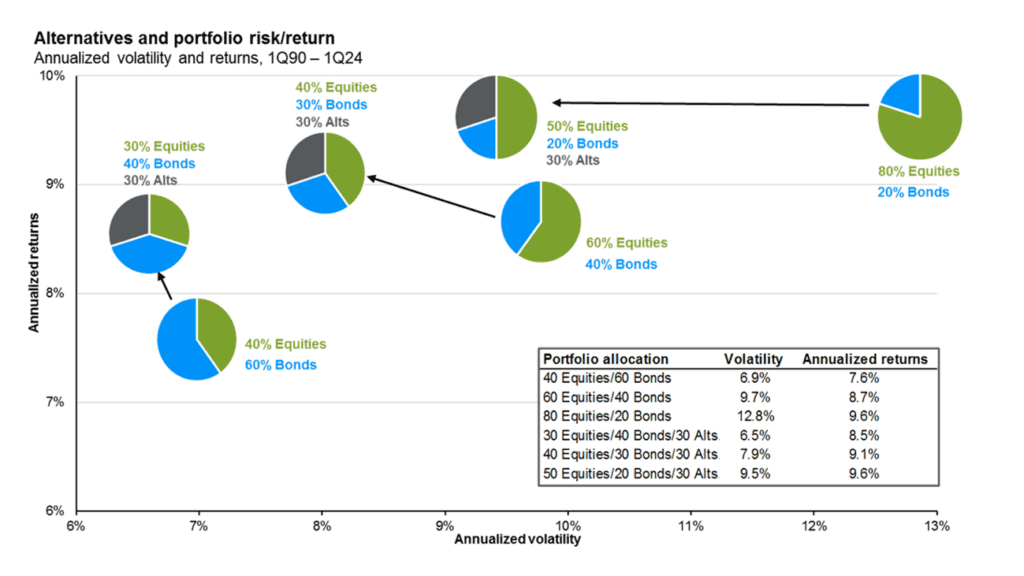

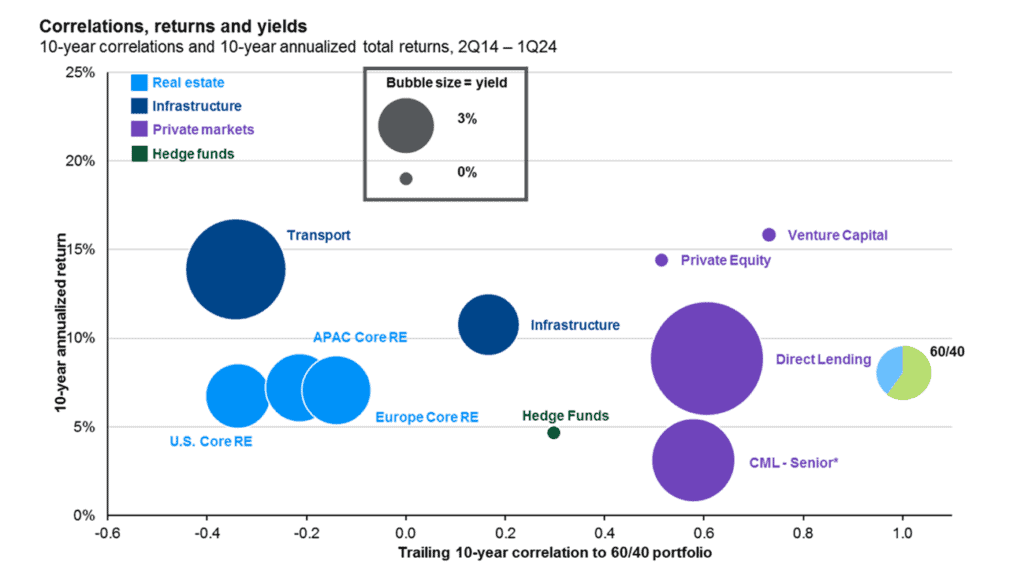

According to a JP Morgan study, including alternative assets (hedge funds, real estate, and private equity) in a traditional portfolio of stocks and bonds helps manage risk and improve returns.

Additionally, the bank pointed out that among the most commonly used alternative assets, real assets like real estate tend to be less correlated with a traditional 60/40 portfolio, while providing solid income generation.

In all cases, alternative assets don’t necessarily have to face the classic illiquidity issues, as they can be securitized to become exchange-traded products (ETP). This process, carried out by companies like FlexFunds, facilitates capital raising, which is why it is gaining increasing prominence among portfolio managers.

But there is more. Specifically, asset securitization also allows:

- Asset pooling: different source assets can be consolidated into a single security.

- Transparency: all assets are reported by the portfolio manager.

- Protection: a special purpose vehicle (SPV) is used to isolate the asset from the issuer’s credit risk.

- Dilution prevention: the ETP avoids diluting existing stakes by performing subscriptions at recent net asset value (NAV).

For these reasons, more and more asset management experts are opting to take advantage of asset securitization to build cost-efficient strategies. Remember, for more information on this process carried out by FlexFunds, you can contact our team of specialists.

Sources:

https://www.pwc.com/ng/en/press-room/global-assets-under-management-set-to-rise.html

https://www.rbcgam.com/en/ca/learn-plan/investment-basics/why-its-important-to-diversify/detail?disclaimer

https://www.gminsights.com/industry-analysis/artificial-intelligence-in-asset-management-market

https://www2.deloitte.com/content/dam/Deloitte/de/Documents/technology/Asset_Management_Disrupted_Use_Cases.pdf

https://am.jpmorgan.com/ca/en/asset-management/institutional/insights/market-insights/guide-to-alternatives