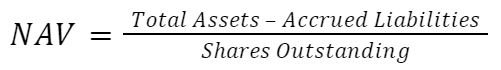

- The NAV (Net Asset Value) is a critical concept in the investment funds and exchange traded products (ETPs) industries; it represents the intrinsic value per unit of these financial instruments. The distribution of this value offers increased transparency and more information for the participants. A clear picture of how NAV is calculated is essential when launching a fund to the market.

- The defined investment strategy will affect the asset classes and costs of the vehicle and influence the frequency at which the product price is updated.

- Through FlexFunds’ asset securitization program, asset managers can repackage multiple investment strategies, with services such as automated NAV calculation and distribution via leading financial data and price disseminators like Bloomberg and SIX Financial. To learn more about it, contact our team to determine which solution suits your needs.

Regardless of the strategy, underlying, or asset class that comprises an investment fund, a fundamental characteristic for the fund is its pricing. Although, in the short term, Exchange Traded Funds (ETFs) prices can be impacted by supply and demand forces, the variable that balances the market and acts as a pricing reference is the NAV (Net Asset Value). We mention balance and reference, given that when the price of an ETF trades above the NAV, the authorized participant or liquidity provider of the ETF will exploit this arbitrage opportunity until the market value converges with the NAV. Likewise, when the price is below the NAV, the market maker of the fund will identify this inefficiency, and the price will end up balancing.

Even though all the products that have a NAV will not necessarily have an authorized participant (usually, the authorized participant will exercise the market maker role as well), any imbalances and discrepancies between the net asset value and market value, at which the financial instrument can be acquired, will be spotted and eventually corrected by an arbitrage effect.

Now, what is the NAV? The net asset value represents the intrinsic value per share of vehicles such as ETFs (Exchange Traded Funds), ETNs (Exchange Traded Notes), UITs (Unit Investment Trusts), and CEFs (Closed End Funds), among others. The NAV is a pivotal concept that provides transparency for investors and allows them to track the value and performance of these financial instruments. FlexFunds ensures that the NAV of all the ETPs (Exchange Traded Products) issued under their global notes program are disseminated through the leading market data platforms like the cases of Bloomberg, Refinitiv, and SIX Financial.

Having more clarity about the concept and its relation to investment funds and the different ETP types, let’s delve into how NAV is calculated and its components.

- Total Assets. Composed of the total AUM (Assets Under Management). The asset classes will vary depending on the fund’s strategy; for example, a fund focused on liquidity and with a low-risk tolerance will hold assets such as treasury bonds, certificates of deposit, cash, and any accrued income under these securities. Conversely, a fund with a growth target and willingness to take further risks will be structured by stocks, alternative assets, and derivatives, among others. The frequency with which the total assets are priced will be directly related to the type of asset, as the underlying liquidity will influence the periodicity with which it can be valued and marked- to-market. In the case of the Flex Private Program, generally used to securitize illiquid assets, as is the case for real estate projects, the valuation will be performed on a monthly basis. On the other hand, the FlexPortfolio, employed as a tool to securitize liquid assets (shares, fixed income, or derivatives, to name a few), can have a daily or weekly pricing frequency, depending on the positions held in the ETP.

- Accrued Liabilities. It is the cost structure of the fund, basically the management fee, performance fee, and any other operating expenses of the fund. FlexFunds allows portfolio managers to launch an investment plan to the market through ETPs, which may be achieved in less than half the time and at a lower cost than other alternatives in the market. The expenses incurred by the asset manager to be able to distribute his fund will have a direct impact on the Alpha that might be generated and, on the performance obtained by his clients. This is why FlexFunds’ cost-efficient solution represents a competitive advantage.

- Shares Outstanding. Total notes issued and held by the investors. In the global notes program context, these can be purchased and sold via Euroclear and Clearstream, facilitating the distribution of the securitized product and enabling their custody in diverse private banking platforms and brokerage accounts.

The objective of an ETP significantly influences not only the composition of its asset portfolio and cost structure but also how often the financial instruments are updated, influencing the NAV update frequency.

FlexFunds securitization program allows portfolio managers to design and launch customized investment vehicles through ETPs. FlexFunds acts as the calculation agent for the net asset value (NAV), distributing it among the principal price disseminators according to the defined frequency set on the management strategy, providing a comprehensive tool to the asset administrator that allows to reduce the operating expenditures.

FlexFunds ensures a smooth and cost-effective securitization process for investment managers seeking to expand and consolidate their fund, regardless of the asset being securitized, the fund’s fees, or the total units to be issued. If you wish to know more about how you can boost the distribution of your investment strategy and expand your available investor market, you can contact our team of experts.

Sources:

- https://www.investopedia.com/terms/n/nav.asp

- https://www.investor.gov/introduction-investing/investing-basics/glossary/net-asset-value