- Maricarmen de Mateo, from Compass Group, explained how asset management has evolved over time to include alternative investments, as detailed in the II Annual Report of the Asset Securitization Sector 2024-2025, produced by FlexFunds, in collaboration with Funds Society.

- The analysis is aimed at asset managers and investment advisors who seek to understand why alternative assets have gained prominence over the last few decades.

- At FlexFunds, we create and launch investment vehicles (ETPs) capable of enhancing liquidity in asset management. For more information, feel free to contact our group of specialists.

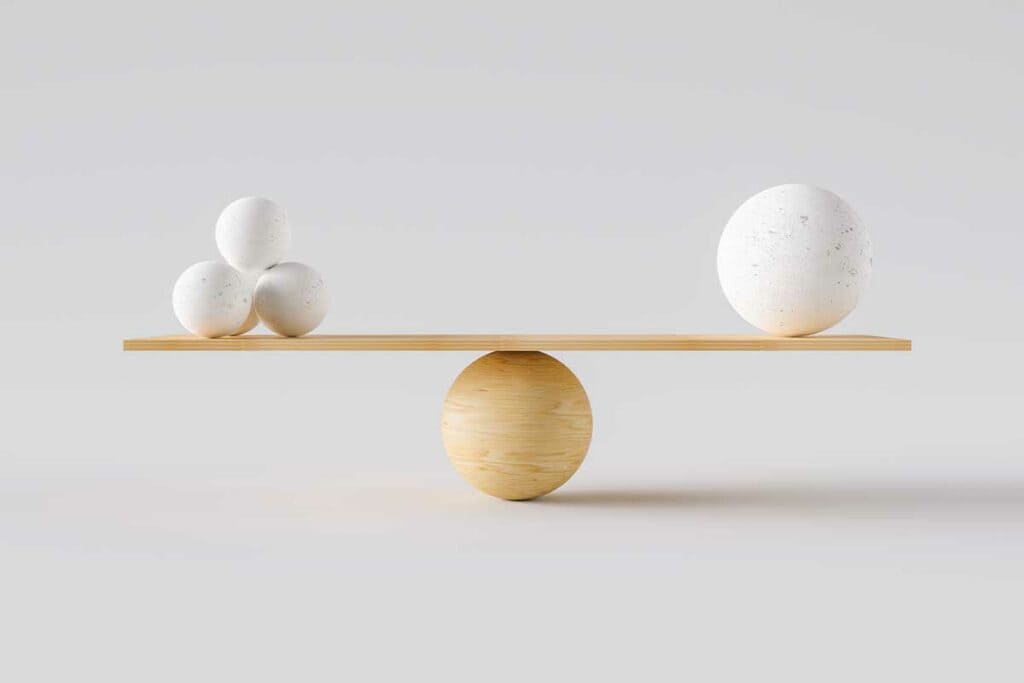

Historically, the 60/40 investment model – investing 60% in stocks and 40% in bonds – has been the most widely used to build balanced and diversified portfolios.

However, over the past 20 years, due to multiple economic crises and extremely low interest rates, this model failed to deliver a favorable risk-return ratio. Among the reasons cited was the high correlation between fixed income and equities, which hindered diversification.

“Just in 2022, the 60/40 portfolio experienced its worst year since the global financial crisis of 2008. Its main drawback was the rising inflation that forced central banks to aggressively hike rates, negatively impacting the value of both bonds and stocks,” said Maricarmen de Mateo, third-party distribution product manager at compass group.

In this context, asset management participants began paying more attention to alternative investments, as reflected in the II Annual Report of the Asset Securitization Sector 2024-2025.

Specifically, 43% of the experts surveyed allocate up to 20% of their portfolios to alternative assets, while 17% invest more than 30%.

According to de Mateo, alternative assets such as real estate, private equity and credit, and infrastructure – tend to exhibit low correlation with traditional assets like stocks and bonds, meaning they can provide additional protection against volatility and help enhance the overall portfolio’s return.

Challenges and solutions

Despite the benefits, de Mateo highlighted two major challenges in managing alternative assets. First, the illiquidity of these investments, particularly for short- and medium-term horizons. Additionally, these assets have historically been reserved for institutional investors and family offices.

Nonetheless, thanks to advances in technology and the development of financial markets, alternative assets are becoming increasingly accessible and liquid through solutions such as securitization, which allows the creation of exchange-traded products (ETPs), like those offered by FlexFunds.

“With greater availability and a wider variety of alternative assets, investors now have the opportunity to build more resilient portfolios, tailored to an ever-changing financial environment,” de Mateo summarized.

The II Annual Report of the Asset Securitization Sector 2024-2025 can be downloaded easily and for free.