- In this article, Juan José Battaglia, Chief Economist at Cucchiara & Cía., examines the key macroeconomic aspects of the U.S. and the main variables monitored by managers and market analysts to contextualize the findings of the II Annual Report of the Asset Securitization Sector 2024-2025, prepared by FlexFunds, in collaboration with Funds Society.

- FlexFunds specializes in transforming various asset portfolios into a liquid and flexible investment vehicle. This type of vehicle is characterized by adapting to different market cycles. For more information, feel free to contact our team of experts.

FlexFunds, in collaboration with Funds Society, published its II Annual Report of the Asset Securitization Sector 2024-2025, which analyzes different aspects of the asset management industry based on feedback from financial experts.

Specifically, a survey was conducted among portfolio management executives and investment experts from 100 companies across 18 countries, mainly from Latin America (68%), North America (17%), and Europe (13%), to understand their short- and medium-term forecasts for financial markets, their views on the asset securitization sector, and much more.

In this context, Juan José Battaglia, Chief Economist at the broker dealer Cucchiara & Cía., reviewed the results related to the macroeconomic aspects of the United States and the main variables monitored by managers and market analysts.

Inflation and interest rates

First, the executive highlighted that the vast majority of asset managers who participated in the survey expect that inflation and interest rates in the United States will be the macroeconomic factors with the greatest influence on markets over the next twelve months.

“Market expectations changed dramatically throughout 2024, with a clear turning point in April. The year began with strong expectations for interest rate cuts by the Federal Reserve (Fed),” he noted.

Current economic expectations are based on two main factors. On the one hand, the inflation trend observed in 2023 has created a more favorable environment for investment decisions. On the other hand, the recent challenges faced by regional banks in the U.S. have caused a decline in the yield curve, which has influenced market outlooks for the coming months.

For Battaglia, the early 2024 inflation data, which exceeded expectations, “was a cold shower,” leading the market to revise inflation estimates upward, delaying the increase in implied rates in futures markets until 2025 and causing the 10-year rate to rise by 70 basis points.

The situation began to change in April, when economic data started to “bring calm” to the bond market.

“The labor market continued to show signs of normalization. The ratio of job vacancies to unemployed people eased after post-pandemic peaks and nonfarm payroll data pointed in the same direction. Inflation data from April, May, and June solidified the easing of negative expectations, finally aligning the market consensus that the Fed has control over the inflation situation,” the economist said.

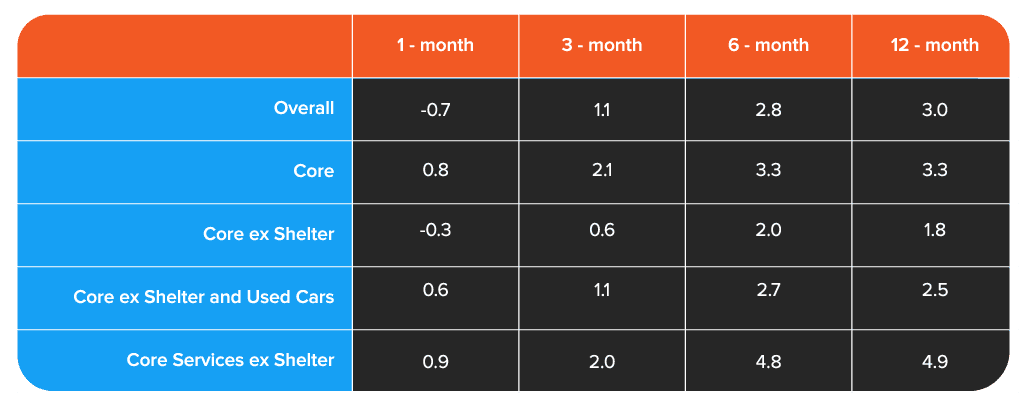

The table below details the annualized rate for different time windows (from 12 months to the last month) for the various inflation measures. The annualized inflation rate for the last three months shows a clear decline compared to the rate of change over the last 6 and 12 months, for any chosen indicator.

Conservative positions

Moreover, according to the data from the II Annual Report of the Asset Securitization Sector 2024-2025 by FlexFunds and Funds Society, the expert explained that, due to the aforementioned macroeconomic factors, most investors are demanding more conservative positions, as corroborated by market multiples.

“The market’s estimated net margins for the next twelve months reached 13.5%, similar to the 2021 highs before the sharp market correction in 2022. While they did not reach 2021 levels, the P/E and EV/EBITDA multiples are also heading in that direction,” Battaglia stated.

According to Battaglia, the equity risk premium (ERP) of the S&P 500, compared to short-term Treasury bill yields, is at historic lows over, the past few decades. In this context, when market valuation multiples expand, the natural investor response is caution. This strategy is particularly effective in an environment where prudence can generate excellent nominal and real returns, considering the comparison between Treasury bills and inflation.

Remember that the II Annual Report of the Asset Securitization Sector 2024-2025, prepared by FlexFunds in collaboration with Funds Society, can be downloaded easily and for free.